It is such a great feeling to create a spending plan for the upcoming month

A feeling that you are fully in charge and gaining control over your finances and future

As you are never worried about paying your bills and credit cards

Where you are capable of fully covering your payments especially your credit cards balance

I really feel sorry for those who believe building a family budget is complicated and not for them

Anybody can create a spending plan as long as he/she can use a calculator

I want you to continue reading below and see if you are still not able to create a spending plan for your household

Let me start with the following

What is a spending plan

When you create a spending plan, you specify a clear path for all the channels or expenses you want your income or take home pay money to go to

Instead of losing track and figure out that your take home pay money went to wrong channels or allocated more into undesired channels

Spending plan vs Budget

Spending plan is typically the same as budget

The reason I am using the term spending plan because I want you to love the concept of managing your household income

A lot of people don’t feel comfortable with the term budget as it brings a sense of deprivation, suffering and hard work

This actually reminds me of my son who refused to take the antibiotics as it is very bitter so I had to replace it with similar drug with delicious taste

So It doesn’t matter if you create a spending plan or a budget

What really matters the fact of overcoming the fears of its complexity

Once you start a speeding plan you would realize it is so simple

What are the benefits for creating a spending plan

Imagine having a genie monitoring where every dollar that comes out of your pocket go

He also stops you from overspending on something you could have controlled it earlier

And he cares about your future and keeps nagging for you to save money

That is the benefit of creating a spending plan

You want to monitor where your income is going to stop living paycheck to paycheck

And force you to save for retirement and to build an emergency fund

Also to act as a debt collector to pay your debt and save you on accumulated interests

Finally to keep you in control of your finances

What are the key concepts to consider before you create a spending plan

Be realistic when you create a spending plan that you can apply it to your family

Also be flexible to modify it when needed

There is nothing wrong if you admit you made a mistake and to correct it

Review your monthly spending plan before the start of each month as income and expenses change frequently and you need to adapt the new changes

But keep in mind the following key concepts when creating a spending plan

Income vs take-home pay

Income is not always the net pay, it is most likely the gross income before taxes

E.g. if your income is $60,000 per year

It doesn’t mean you will get paid $5,000 a month or in other word you divide your income by 26 biweekly checks assuming you get paid biweekly

That’s why you have to create a spending plan based on your take home pay which reflects what you earn after taxes

In our previous $60,000 income if we apply your provincial tax or state tax then your take home pay can be around $45,000

This is what you use when creating a spending plan

Tracking your spending

When you first start your spending plan you will be in a hit or miss position

You estimate an amount for specific expense and you get different spending result either deficit or surplus

You have to keep track of your daily spending for a month or two

Other alternative if you can go through all your credit cards and analyze your spending into different categories

For example, if you find four or five separate spending related to grocery

You sum them together and come up with an estimate amount for how much you plan to spend on grocery

What are the three types of expenses

Not all expenses are the same as you have fixed, flexible and discretionary

You have to know the difference between all of them

Fixed expenses

This is what you have to pay as is so it is the same amount every month

That’s why it is called fixed expenses like mortgage/rent, phone bill, internet subscription and cable

Flexible expenses also known as variable expenses

It is called flexible or variable expenses because you have full control over them

If you are diligent and educate yourself on how to save money on these types of expenses definitely you will get some money in your pocket

An example of a flexible expense is your spending on grocery

It is clear example on flexible expense which you can act smart to save money on grocery

Discretionary expenses

Your morning coffee or GYM membership is a clear example of discretionary expenses

What is discretionary for me can be essential for you so no judge here

Everyone of us has at some point few expenses that you can cut or replace them with cheaper ones

For example, in my post for 101 best ways to save money I saved almost easily $450 annually by replacing my cable subscription with an IPTV

What are the 6 steps to follow in the spending plan process

When creating a spending plan one of the key success is to analyze your numbers

Don’t worry if I use the word “analyze”

Because you will analyze without even knowing that you do that

You are going to subtract what you spend monthly from your earnings

You will start to get the sense of how to play around your expenses to maximize the Gain part and minimize the Loss part

Follow the below steps to be able to create a spending plan that take you out of debt

Add all your monthly expenses

One of the challenges for those who are creating a new spending plan is that they forget few expenses

This is normal, it happened to me but the good news is that once you finish adding all of your familiar expenses

You can review all methods of payments like debit and credit cards and see what else you can include

Add your household net income as known as take-home pay

Add all take home pay money on your spending plan even if you have seasonal earnings like tax refund

It will be always zero for all months except the month you file your tax return

Deduct all expenses from take-home pay

If you remember earlier the three types of expenses fixed, flexible and discretionary

You have to deduct all of your expenses from the take home pay

A smart idea is to deduct only all fixed expenses from take home pay

You need to know how much money left on your spending plan to manage

If you subtract $1,960 from $7,095 then you have $5,135

Keep in mind that this is just an example

In reality you have to add few fixed expenses like cell phone bills, internet and cable subscription

Lay down your financial goals or priorities

I always say it loud to come out of debt you have to save money

But how? When you create a spending plan you see all expenses

So you can make a wise decision to pay yourself first by deducting from your take home pay a certain amount every paycheck and transfer it to your saving

It doesn’t work any other way so you have to lay down your financial goals and priorities to figure out how to manage your expenses after saving money

Allocate money to savings and financial goals

Whatever you have a financial goals on mind like planning to buy a home and you plan to save the 20% down payment

There are already existing goals you have to pursue like building an emergency fund and saving 10% for your retirement

I mentioned the emergency fund before retirement saving on purpose

You cannot save for retirement while missing emergency fund because when you start working on your spending plan you will encounter all of the sudden bills you have to pay

You have to pay these urgent bills and not get distracted from your retirement saving

But if you pay it from your emergency fund you can keep saving for retirement on a monthly basis without interruption

Review your spending plan against savings and financial goals

Always keep on reviewing your spending plan against your savings

This is an ongoing process that keeps on changing and you have to adapt for these changes

For example, one month you can get something urgent that requires to use the emergency fund

You start again to build it up or you can get 3 paychecks in one month

Yes this happens twice a year so you can add extra buffer to your emergency fund

Typically your emergency fund should cover 3 to 6 months of all of your expenses

Spending plan worksheet and how to use it

I discussed before how to create a digital spreadsheet budget

I showed you how to use a ready made spreadsheet spending plan and how to create your own from scratch

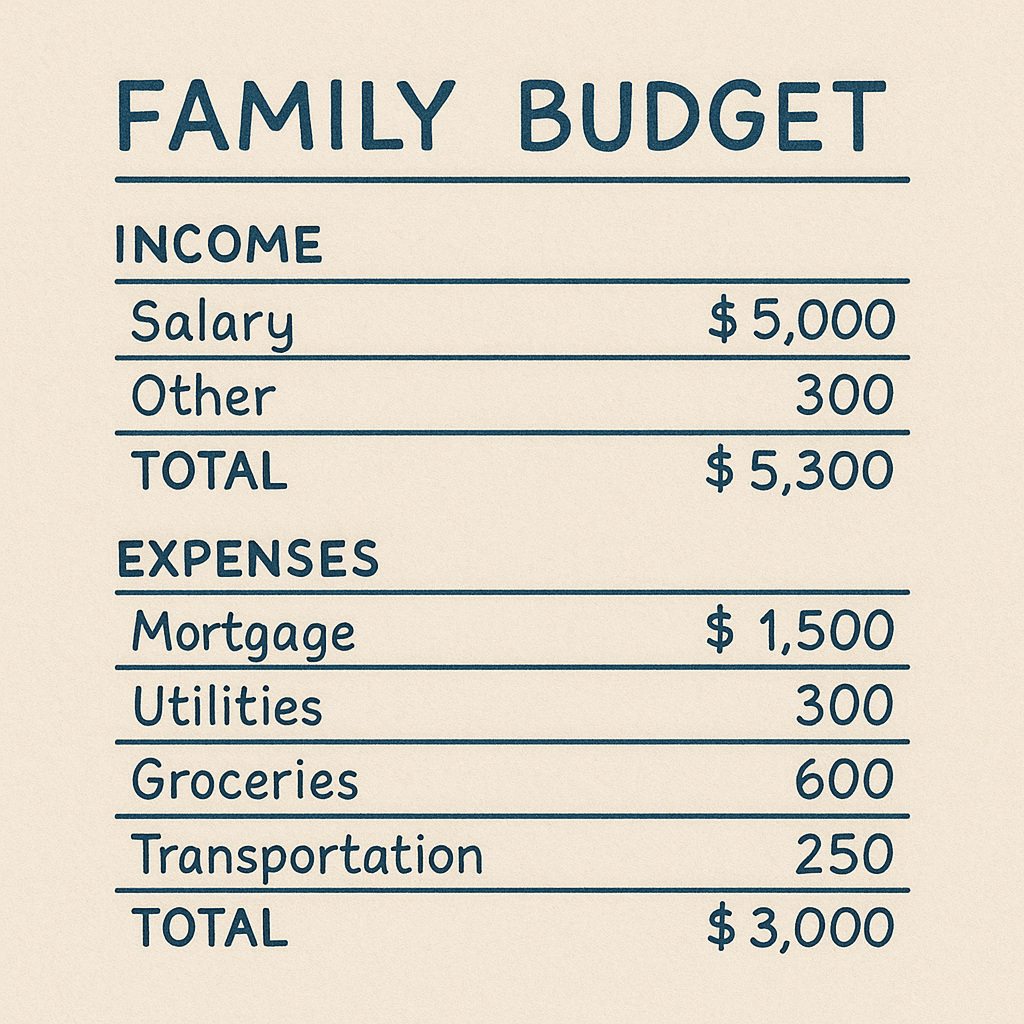

This spending plan shown below

I created for you to use before beginning of any month

The best feature I love about this spending plan spreadsheet is that it calculates any amount as a percentage according to the overall total income

Even individual income itself is calculated as a percentage to the overall total income

You can skip the estimated column if you feel it is a redundant work but keep in mind to ignore the negative values under difference column

Click to download for free from my products page

Don’t forget your password to edit data is 0000

To get the full flexibility to modify it to suit more of your needs

You can download the budget word document and the editable budget in excel sheet for $2

When comparing spending plan spreadsheet vs paper spending plan

I am not against the spending plan spreadsheet

I always stand anything than makes my life more convenient

But using a paper spending plan is one of the things that keeps you focused on your financial goals

Just hang it on your desk or your fridge and look at it every now and then

This will stir your brain to think about several ways to save money for your family

That’s why I still use a paper spending plan after finishing my assessment on the original spending plan spreadsheet

That’s why I encourage you to download this free printable spending plan

Click to download for free from my products page

Looking for extra flexibility to edit your spending plan in Word document

What about if you download both Word and Excel sheet together for

You can download the budget word document and the editable budget in excel sheet for $2

I hope I was able to help you overcome any doubt that made you believe creating a spending plan something complicated and not for you

According to creditcards.com Americans accumulated $1.0645 trillion in April 2019 on credit cards

That’s because they don’t create a spending plan to tell them where their earnings should go

Now after you are done with your spending plan what if you are living paycheck to paycheck

Or still struggling to get your spouse to commit to your spending plan