Creating a family budget should be a fun time for the family where couples meet together before the beginning of each month

I refer to family budget here to those families who have kids staying home with them

When me and my wife started monitoring our spending plan during different stages of our lives

Do you know that the term spending plan is synonym to the word budget

If you feel the word “budget” brings a feeling of complexity, replace it with the term spending plan

We noticed a significant changes in our budget when we were DINK which stands for Dual Income No Kids

Compared to our situation of 2 boys with 20 months age difference between them

Every stage you go through with your child requires different spending plan

Also every stage has its significant expenses like infant and part of toddler’s stage require buying diapers and certain type of baby food like formula

And when they go to the daycare, you pay significant amount where you have to plan for it properly

Anyway, I will go through all the steps required to build a budget and I will start with

How to start a family budget

Actually I highly recommend all couples to agree on creating their family budget together even before having kids

This kind of family budget is simple with less items so practice creating one and more to it with your kids at different stages of their lives

1- Choose your budgeting tool, paper or electronically

Although I am a big fan to anything that makes my life easy

But I highly recommend to start using your budget on paper first

You need a sheet of paper and simple calculator

When you start your first budget on paper

You need to calculate the percentage of each of your income and expenses compared to your total income

After you complete your first budget on paper

You can start copying the numbers on excel sheet to get use to the electronic copy

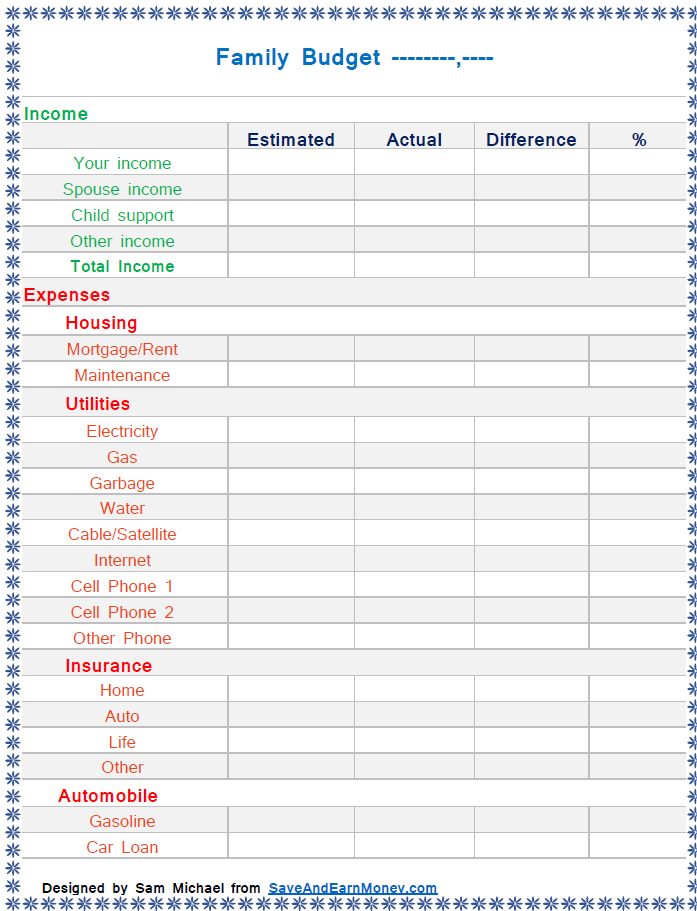

I made it easy for you to use a ready made free printable budget in PDF

Click to download for free from my resources page

But if you want more flexibility to add/edit any budget items according to your taste

You can download the budget word document and the editable budget in excel sheet for free

For complete flexibility to modify and add any new expense

Click to download for free from my resources page

2- Collect all of your bank and credit cards statements

For those families who think it is a challenging and hard task

It is a little bit when you first create your initial budget

Later on you have a ready process that takes less than 10 minutes of your time before the beginning of the month

But first you have to collect your bank and credit cards statements for the last 3 – 6 months

Don’t be deceived by creating your first budget based on values from one month only

You have to make sure you have so many months of previous expenses to make a proper assessment based on realistic datado it one time and let it take whatever it takes and every consecutive months will be a piece of cake

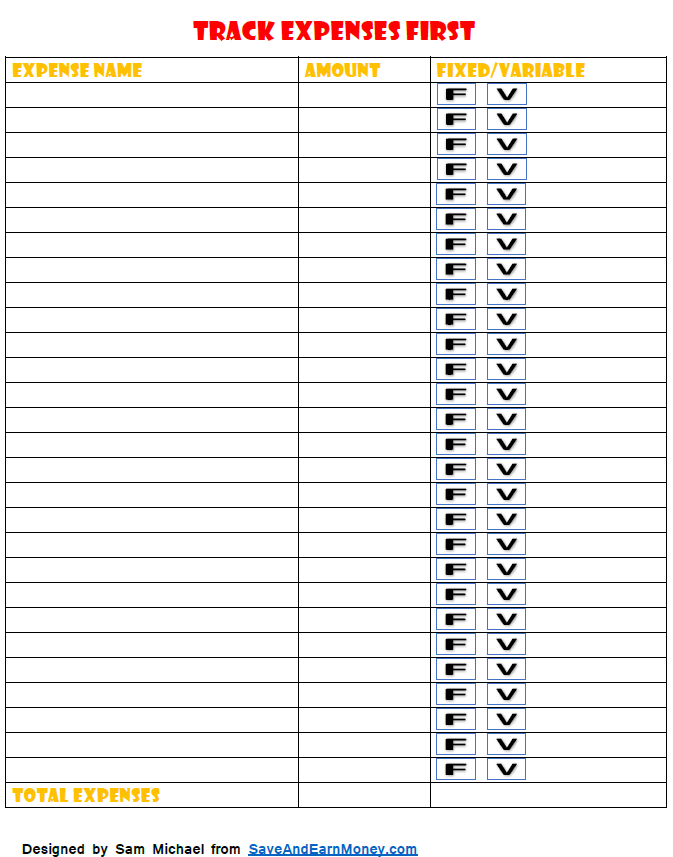

3- Determine your fixed and variable expenses

This is a mandatory step

You have to determine what is fixed and what is variable when it comes to expenses

For those who don’t know the differences between them

Fixed expenses: any expense that cannot be controlled and lowered like Mortgage/Rent, Netflix, Cable, Cell phones..etc

You got the idea, of course you can change them but I mean it is feasible

Variable expenses: any expense that you completely have full control over them like groceries, clothes, discretionary expenses, dinning out

I have a free printable Expense tracker to download and start assessing your expenses

By the way, the real purpose of the free printable income expense tracker below is to determine if your income covers all of your expenses with deficit, surplus or almost zero balance

Click to download for free from my resources page

4- Determine your discretionary expenses to cut

Everyone has a discretionary items to splurge money on

It can be a hobby or your morning coffee

For myself, I know I am very week to resist buying chocolates – all different kind of chocolates

Also I am addicted to Starbucks coffee

Situation is different after having my 2 kids

I didn’t change completely but I always put my kids in my thoughts when thinking about any expenditures

Find out what expenses you can cut without even noticing that you sacrificed anything in your daily routine

5- Adjust your budget frequently

A family with growing kids makes your budget changes rapidly

One day you can add diapers in your spending and all of the sudden they go away

Always embrace this frequent changes and consider it a good opportunity to save the money you used to spend on any gone away expenses

For example, I used to pay for baby formulas more than $120 monthly

After I stopped spending money on baby formulas, I started saving a little bit of extra money into kids RESP – Registered Education Savings Plan

6- Working on paying off your debt as a priority

Nothing can beat the feeling of overcoming your debt

It is a feeling of joy as you are not slave anymore to sleepless nights

According to Dave Ramsey’s book Total Money Makeover where he put a new approach to pay your debt

He asks anyone who wants to pay debt to sort them in amounts from low to high regardless of interest rate and pay more into the lowest

By following this approach, you get a strong power of enthusiasm to continue fighting your debt as you see one debt is going away

Of course, there is an exception to this rule, if your debt is a government due taxes or any obligatory debt to pay

7- Think about all the family financial goals together

I always have this debate with my wife on how to distribute our annual tax refund between different investments

You have many savings for the future like saving for RRSP in Canada or IRA in US and saving for RESP in Canada or 529 plan in US

You have to compromise between saving for yourselves as a couple for retirement and saving for your kids’ future educations

8- Build your savings

Since educational saving in Canada for kids has a cap limit and the government match 20% of your contribution up to $2,500 so I always maximize it to get the maximum benefit

For the retirement saving, most companies match up to a certain percentage of what you contribute so always maximize your contributions

If you have the option to move any bonus to your retirement saving plan, I encourage you to do that because if you transfer your bonus to your retirement saving it will not be taxed so you add the full amount

What are the types of family budget

Deficit budget

Deficit budget when you find that your expenses are greater than your income and you are subtle to fall in debt

You will not notice it if you don’t build a monthly budget

I was once in this situation and I realized that after I managed to have a monthly budget

So how was the deficit managed without my checking account going negative

Simple answer, yes I was in deficit

But because extra income like tax refund and bonus come in during the year

Beside last 4 or 5 months of the year the take home pay is somehow higher due to finishing the deductible taxes on the first months of every year

My idea is you should manage to get out of deficit without replying on your bonus or tax refund

Surplus budget

Surplus budget occurs when you are able to cover all of your expenses and still have extra money that get accumulated in your checking account

This is not the right decision to keep your extra money sitting in your checking account

Neither deficit nor surplus with money in your checking account is right

If you are steadily having surplus then you should manage to increase your retirement contribution or educational saving plans for your kids

Balanced budget

This is the typical case where you learn from your monthly budget numbers and manage to make use of every dollar in your income

What is sample budget and how to use it

Sample budget is a budget from another household or family

You can use it to avoid common budgeting mistakes but you cannot rely on their numbers to apply it to your situation

Every family is different from others even if having the same number of kids and their ages even if they live in the same city

Also it is completely wrong to see how others spend their money and build decisions based on these spending habits

You can download for free the above blank family budget PDF to help you start with your own numbers

If you want to sum all numbers to get a proper percentage of each expense compared to the total income then you can download free the family budget sheet above

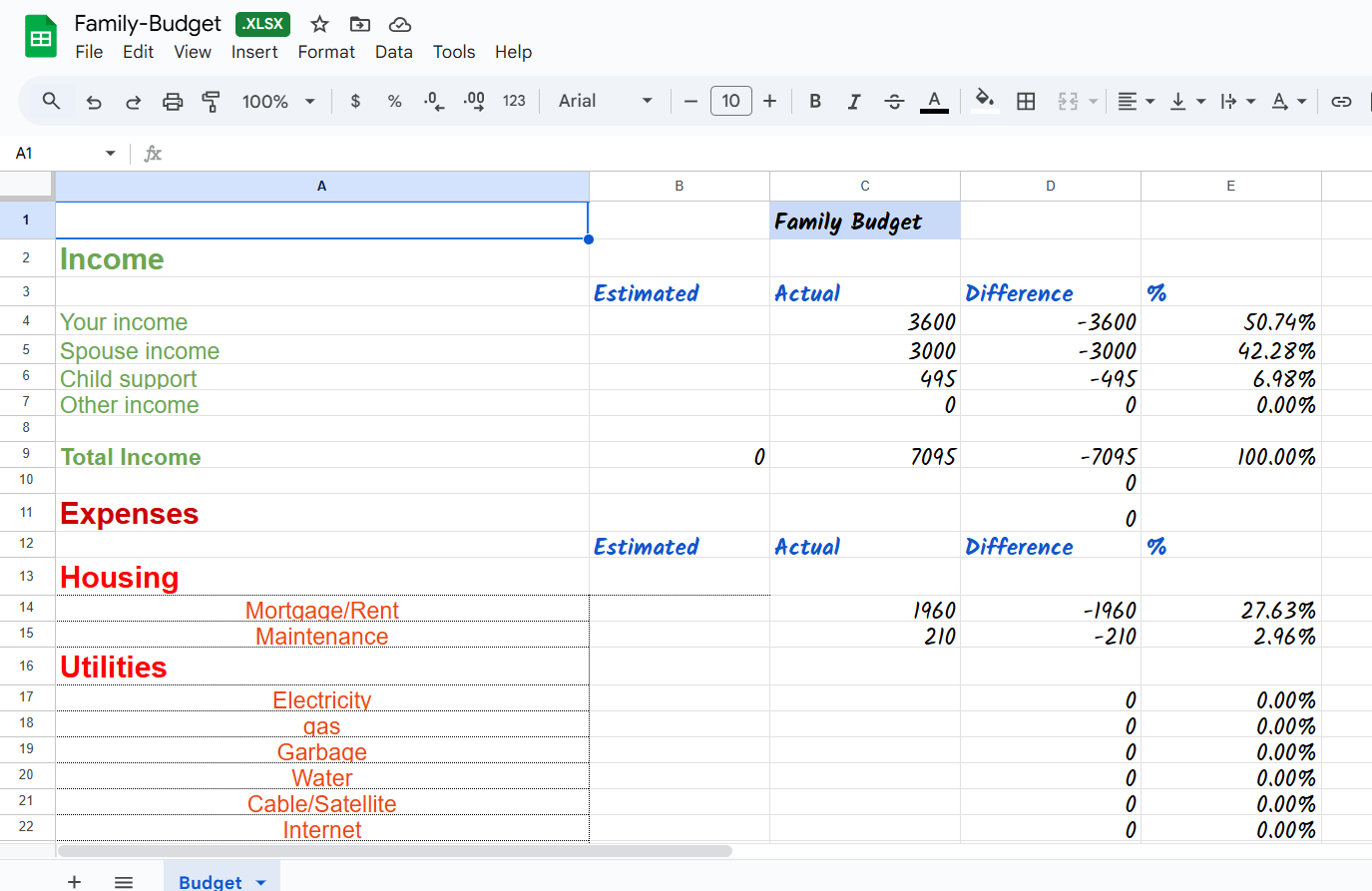

How to create a family budget on excel sheet

One of the best thing to save time for you and to make you fall in love with the concept of maintaining your family budget on a monthly basis is to use budget on excel sheet

I have discussed before on how to create a digital budget in spreadsheet, I recommend you to go and check it

I assume if you have panic from numbers just spend 5 minutes to get familiar with the steps I mentioned to create your own budget sheet and I guarantee you will definitely master it

Now your next step is to join my mailing list to stay up to date with budgeting, saving money and managing your finances