Do you feel intimidated when you hear the term budgeting? Or when paying your credit cards and bills?

One month you are not able to cover all payments, another month you pay everything and still have something left

Wondering what causes this deficit – surplus game!!

You feel no control over your finances, don’t even know where income is going

Something inside tell you

You should learn how to create a personal budget for your income

So what is holding you back? you think it’s complicated?

Well, you feared building family budget for no reason at all

If you passed grade 3, you should know how to create a personal budget

Seriously grade 3 curriculum, they learn how to add / subtract up to 3 digits with fractions

Since we use calculators, passing grade 3 and being able to use calculators are sufficient to make a successful family budget

I was afraid to budget my income or try searching how to budget my family income

Till one day my wife asked me to export my credit cards to an excel file

It was easy as credit card statements have a feature to export all monthly transactions to multiple formats

My wife categorized them to groceries, utilities, restaurants …etc

Every transaction has an icon that indicates its category

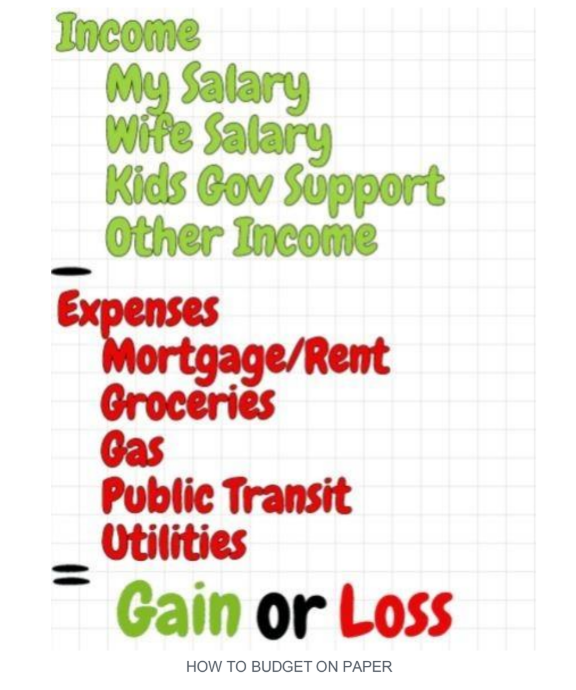

She added both incomes on top, subtracted all transactions as known as expenses like below

That’s it, the above is a simple budget you can use it right away

You can add extra items like clothes or utilities

What is budgeting

Budgeting is the process which you do, like the above image to create a plan for spending your income

After you get the net amount either gain or loss, you create a spending plan by eliminating parts of your expenses

This spending plan is called a budget

Why you need to budget your money

I am sure my wife as an accountant with CPA, she was trying to analyze our expenses and we came up with few cuts to our expenditures

Ask yourself the following

Do you want to know where your money is going and stop living paycheck to paycheck?

Have your started saving for retirement or emergency fund?

Do you want to get rid of your debts and stop paying interests?

Do you want to stay in control of your finances and make the most out of your money?

If the answer is yes to some or all of the above

Then you have to learn how to budget your income right now

A budget is telling your money where to go instead of wondering where it wentFrom dave ramsey’s quote about the importance of creating a budget

Ingredients of a successful budget

Any household budget contains income and expenses

Obviously, this is a basic common sense

But I dare to say any successful household budget should include

- Income

- Expenses

- Savings

Although Savings are considered part of the expenses but I consider it healthy expense or positive expense

Things to consider when creating a budget

There are few things to consider when planning for your budget

Don’t copy existing budget and follow its numbers

Remember no 2 budgets are similar even with the same exact income

Your income structure, if it is fixed like salary or variable like working on commissions

Or Your spending habits and your ability to overcome your indulgences

Or Your personality and if you can live a temporary ascetic lifestyle to achieve your goals

1) Think about your short and long term goals

Think about short term goal like building an emergency fund

While long term goal is saving money for retirement

Or it can be saving money for your dream home like $80,000 equivalent to 20% down payment

2) Analyze where your money is going

If you master this process, you will have full control over your budget

Categorize all your expenditures and get control on your spending

Remember groceries almost the same every month while gifts vary based on each month

For example, December is the Christmas or Hanukkah gifts season

Bottom line, you have to understand what affects each category to go up or down

3) Track your needs and wants

Needs are basic things to spend money without feeling guilty like

- Groceries.

- Mortgage or rent

- Basic utilities

- Transportation like Gas and/or public transit

- Insurance like home and car insurances

- Loan payments

- Child care

But in the needs there are items like groceries and basic utilities that you can still revisit if they are all needs or you spend on your wants within them

For example, if you buy caviar and lot of alcohols

Also for basic utilities, do you really need your $40 GYM membership?

Wants are all things you consider to eliminate reasonably on your budget like buying clothes and going on vacation

Question for you, if you waste a lot of money buying gifts on Christmas or Hanukkah

Would you suggest drawing of names for gifts?

What are the four steps required in a budget

Very easy and simple 4 steps

Step 1 – Money In as Income

All paychecks along with child support if you have, annual bonus and tax refund

Step 2 – Money Out as Expenses

Step 3 – Evaluate your situation

Case 1 – You are in deficit as your income is not sufficient to cover your expenses

Consider cutting aggressively on your flexible expenses like groceries or non essential utilities

Check how much you pay for your mortgage/rent

If your mortgage/rent is more than 40% – something is wrong here

You either have to downsize your home or negotiate your rent otherwise find another place to rent where you can afford it

Or

Consider working on a side hustle

Or

Consider working to reduce your expenses by reading my best ways to save money

And learn how to save electricity and pay less on your bill

Also practice cooking cheap meals plan under %75 for a family of four

If you are in debt, follow this guide to pay off debt fast

Falling in debts can be due to uncontrolled spending

Check your expenses and practice living frugal life

There are 100 more websites to get free stuff online so it is worth to try them

Best advice is to negotiate your bills and track your expenses, I recommend you to use these apps below available on Android and Apple iPhone

In US, you can use AskTrim, BillSmart, BillCutterz, BillFixers and Bill Shark

In Canada, you can use Bill Busters

Case 2 – Your income covers basic expenses but not all flexible expenses

You are in a better position but having extra money after paying your credit cards and bills without a plan is useless

Because one month you have extra expenses, those money in the same checking account will pay your expenses so you did not use your surplus from previous months to start a dedicated saving plan

Start with reasonable amount to save and consider cutting more on your discretionary items

I would say start first to build an emergency fund with $1,000 to save aside

After you complete your emergency fund then start your retirement saving plan if you don’t have one

Case 3 – Your income covers all your expenses with always a surplus

Build the emergency fund right away along with starting the retirement saving plan together

You have more room for improvement

You can go for the 52 weeks money challenge to save like $3,000 a year

Step 4 – Try the proposed solution and revisit your budget again for adjustment

What are all types of Budget methods

First I really believe in donations and giving tenth according to the bible

That’s why I liked any type of budget that consider giving donations

6 Remember this: Whoever sows sparingly will also reap sparingly, and whoever sows generously will also reap generously. 7 Each of you should give what you have decided in your heart to give, not reluctantly or under compulsion, for God loves a cheerful giver.2 Corinthians 9:6-7

1) 10% Savings

10% saving rule requires you to save 10% of your income for retirement

Those who want you to save 20% of your income, I believe they don’t donate and this makes sense

You cannot donate 10% and still save 20%

I would choose to donate 10% and save 10%

Again I am not here to preach you

2) The reverse budget method – Pay yourself first

The reverse budget method is also called pay yourself first because you just deduct the saving amount first when you get paid

You prioritize your savings over all other things

Then pay your bills or if you are getting paid on a different day other than the day you pay your bills then make sure you reserve money to cover your bills

The reverse budget method is also called spending plan after saving

The only disadvantage of using the reverse budget method is that you don’t track where your money goes for the rest of all expenses

3) Zero sum budget method

Zero sum budget employs every dollar you get from your income

It is called giving every dollar a job to do

And so you get a budget net value of zero

This strategy implies getting a net positive value and using it in a proper saving channel

That’s why the zero sum helps you to get the mindset of minimizing your expenditures and get a net value to invest in savings and retirement

4) The cash envelope budget method

The envelope method is very tough

Actually I can’t follow it, it assumes you spend your budget using cash only

If you assign $500 on grocery, you add $500 cash in an envelope labelled food

You manage to spend money gradually on food using this food envelope

When you are done, it is over no exception

5) The value based budget method

With the value based budget method, you assign money to your most value thing

For example, if you have passion about travel then you set an amount monthly as travel fund

Again you don’t track your money on all expenses but it helps you prioritize your money which you set aside to one value

6) The half payment method – living paycheck to paycheck

The half payment method is not complicated at all

Simply it is called the half payment because it divides each bill into two halves

It assumes you get paid biweekly and each bill is paid monthly

Now you distribute each half bill amount into 2 weeks contributions till you get you next paycheck

The half payment budget method is really good if you are living paycheck to paycheck

For example, if you get paid $1,400 biweekly and you mortgage/rent is $900

Then you have half mortgage/rent payment of $450 to set aside and $950 left out of your paycheck to spend on other living expenses

It just needs discipline and it is better to start it with one big bill and see it works

Then you can add bills to it later on

7) The 50/30/20 Budget method as known as balanced money formula

The 50/30/20 budget method also known as the balanced money formula

It allocates 50% on needs, 30% on wants and the remaining 20% to savings

8) The 10-10-80 Budget method

This 10-10-80 budget rule assumes any household needs to spend 80% from earnings to live comfortable

They donate 10% and save 10%

Assume that you save 30% of your income and spend 70% on your living expenses

9) The 70-20-10 Budget method

The 70-20-10 budget rule looks to me like a detailed plan to the 70/30 budget rule

Where 70% goes towards living expenses

20% for savings detailed like 10% goes to retirement saving, 5% for emergency fund and the remaining 5% for saving goals like vacation or buying expensive item

10% remaining goes towards paying your debt

What should be included in your family budget?

- Mortgage or Rent

- Groceries

- Home and Auto insurance

- Medical insurance

- Prescriptions drugs

- Irregular expenses as known as emergency expense – not to be confused with the emergency fund

- Household maintenance

- All recurring subscriptions like Internet, Cable, Netflix, Cell phone bills and Car payments if you have any

- Memberships like GYM or web hosting if you have it

- Entertainment

- Social Events like birthdays, weddings and your anniversary

- Holiday expenses like Thanksgiving if you are hosting it, Christmas or Hanukkah gifts

- Donations

How do you create your first monthly budget?

Start your first monthly budget by assessing your previous month expenses from your credit cards or debit

You might get stuck remembering what was this transaction for

Usually most credit cards add category for the transaction like grocery, gas or restaurant

If not, you have the description to remind you

I remember I called my credit card customer service when I suspected a transaction

They have long description better what I see on my statement

1) Get a grid or blank paper, pencil, rubber eraser and calculator

I am asking to work with pencil so expect a lot of editing and shifting things downwards and may be upwards

You also need a simple calculator that can do addition, subtraction, multiplication and division

You can use your cell phone calculator

2) Give your budget a title with month and year

At the top middle of your page, give your budget a title

Make it simple, it is Family Budget or Household Budget followed by month then comma and year

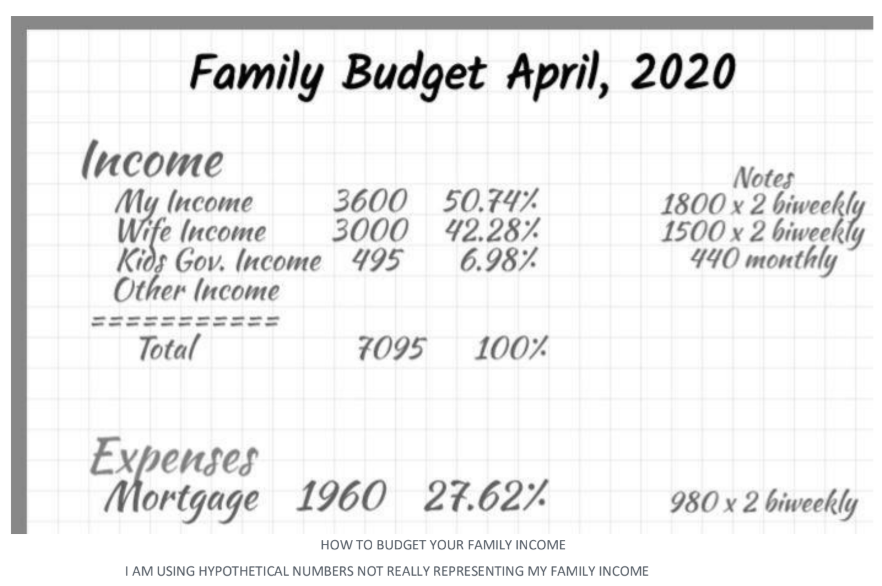

e.g. Family Budget April, 2020 I like to use “family“ more than “household” word, again it is up to you

3) Sketch your paper in advance for expenditures

Income is 2 to no more than 5 – 6 lines while expenses are a big list

Divide 1 to 4 portions

This means start dividing your paper into quarter for Income and four quarters for all expenses

Use indentation to make budget readable

Use indentation to help you glance each section easily

Remember you want to take decisions based on your income and expenses

List fixed expenses on top – optional tip

We have few expenses that are very hard to lower like mortgage or car loans

While other expenses are possible to lower like home and car insurances

Start listing all expenses sorted by hardest to lower down all the way down to these than you can negotiate or replace/cancel them

4) Get familiar calculating percentages

Don’t freak out when dealing with any percentage

Basic rule is, all combined income is 100% that act as the base value used for any percentage

Any expense should be divided by total income and then multiplied by 100

e.g. my family total income is 7095 which represents 100%

It acts as the base for all other numbers to divide upon it

My salary is 3600 as 1800 every two weeks so it is equal to 50.74%

I came up with this percentage as I divided 3600 which represents my income over the total income the 100% value which is 7095

So, 3600 divided by 7095 = 0.507399577167019 x 100 = 50.74%

Keep things simple, I just pasted what my calculator displayed for me

Again 3600 divided 7095 = 0.50739 x 100 = 50.739%

If the number after the 2 digits greater than 5, round the digit left to it by 1

e.g. my result is 50.74 since 9 is greater than 5

Finally, to make sure you have correct percentages

Make sure that all percentages in every income totals up to 100%

e.g. 50.74% + 42.28% + 6.98% = 100%

5) Choose and apply a budget type

I prefer the 10-10-80 budget rule but Why?

First, it addresses the fact that you only save 10% as the other 10% goes as donation

If you don’t donate, then you have a room for 20% savings

Second, the 80% gives you flexibility to adjust yourself to allocate 80% of your income as fixed and variable expenses along with the mortgage/rent payment

6) Fill in the blanks – my solution to your budgeting concern

Now you have all components ready and you know how to calculate the percentages

Doing your own budget can be fun and intriguing

It brainstorms your mind to think about saving money on everything

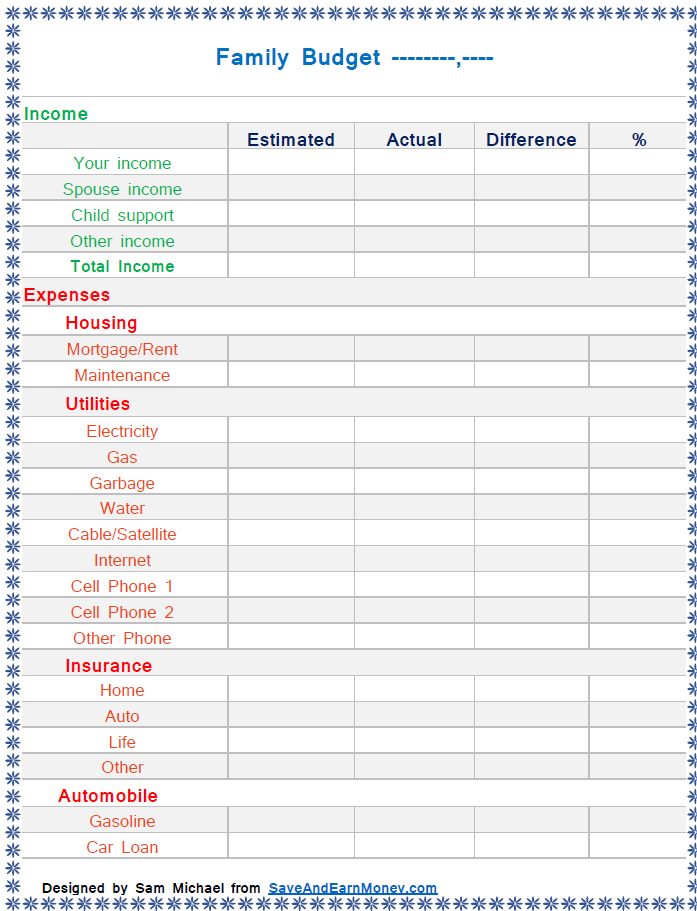

Click on the link below to use a family budget PDF right away

Click to download for free from my resources page

If you want the flexibility to download it as a Word document to modify it according to your taste

You can get both the Word and Excel file together for $2

How do you make a digital spreadsheet budget?

You understand now how to budget your family income on paper

Same budget you can convert it to digital spreadsheet as shown below

Option 1 – Use a ready made template

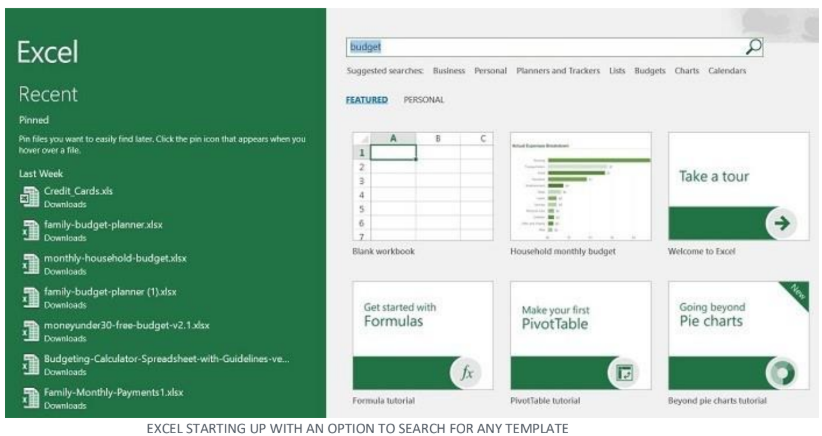

There are so many digital sheets like Microsoft Excel, Libre Office, Google Sheet and Open office

All of them come with budget template ready made for you to use right away

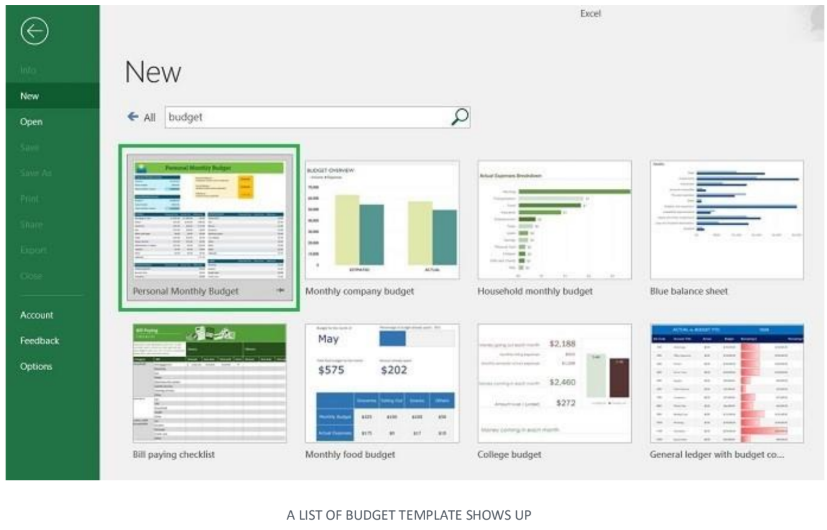

I will use Microsoft Excel as an example here

Just launch Microsoft Excel and type the word “Budget” as shown below

A list of different templates related to budget shows up

I will select the personal monthly budget as shown below

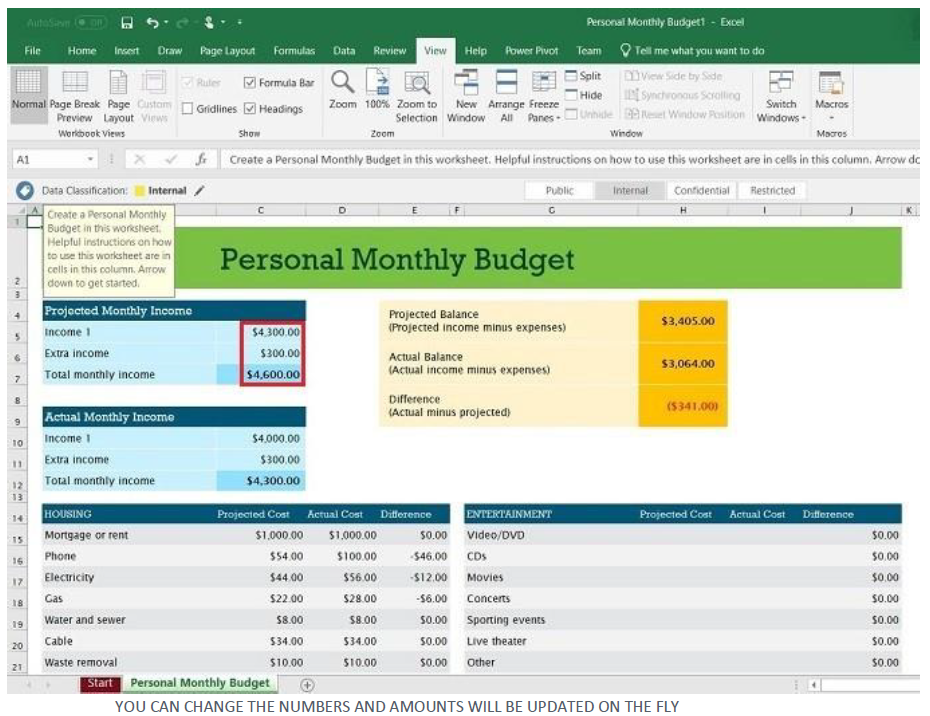

A carousel of templates showing your clicked template with a navigational arrow to the right

You can navigate back and forth to next templates on the list

Click create to initiate a new copy of personal monthly budget as shown below

The personal monthly budget loads up with existing numbers as an example

You can now change the monthly income and all the calculations will be updated on the fly

Option 2 – Create your own digital spreadsheet budget

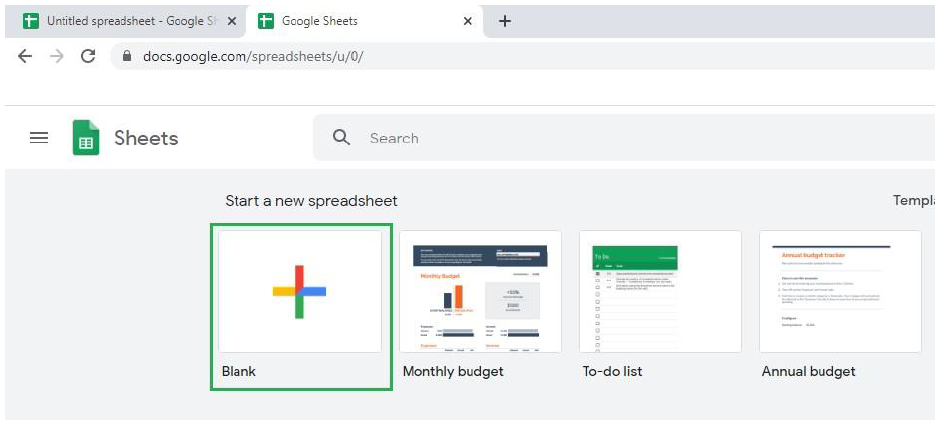

I would like to create my digital spreadsheet budget on Google Sheets

This gives you flexibility to access it online anywhere and from your cell phone

Also you can share it with your spouse

Once you create a new budget, you can clone it for following months

So let us begin by going to https://docs.google.com/spreadsheets/u/0/

If it asks you to login, you can use your existing gmail account or create a new gmail

Or you can sign up with your own non gmail email

First click on Blank to create a new family budget for specific month and year

Rename your budget to Family Budget April, 2020

This is just an example, change it to whatever month and year you like

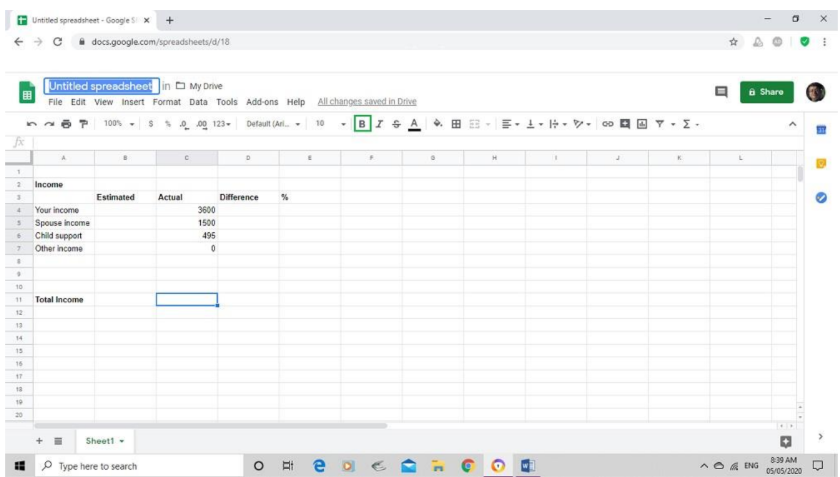

I prefer to start the Income header on row 2, in case I want to add a title on row 1

You can bold few cells by using the B button in green box

I made Income, Total Income, Estimated, Actual, Difference and % as bold

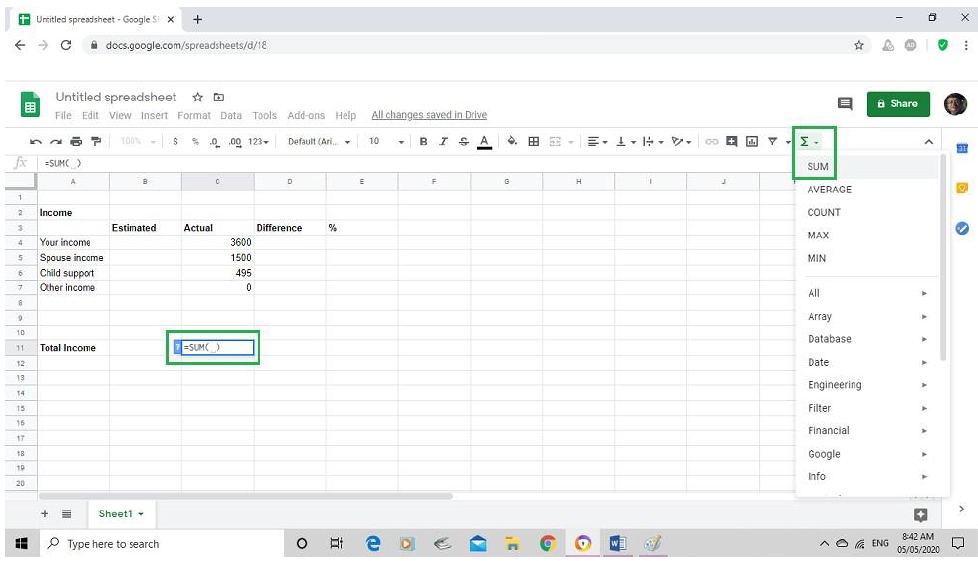

Click on cell C11 to prepare to sum all previous incomes

Go to the sigma sign and select SUM as shown below in green box

By default, all numbers starting from cell C4 3600 to cell C7 0 will be selected

To specify a range, just click on the beginning of the cells where you want to start your addition

Then hold the shift and click on the end cell where you want to end your summation process then hit enter

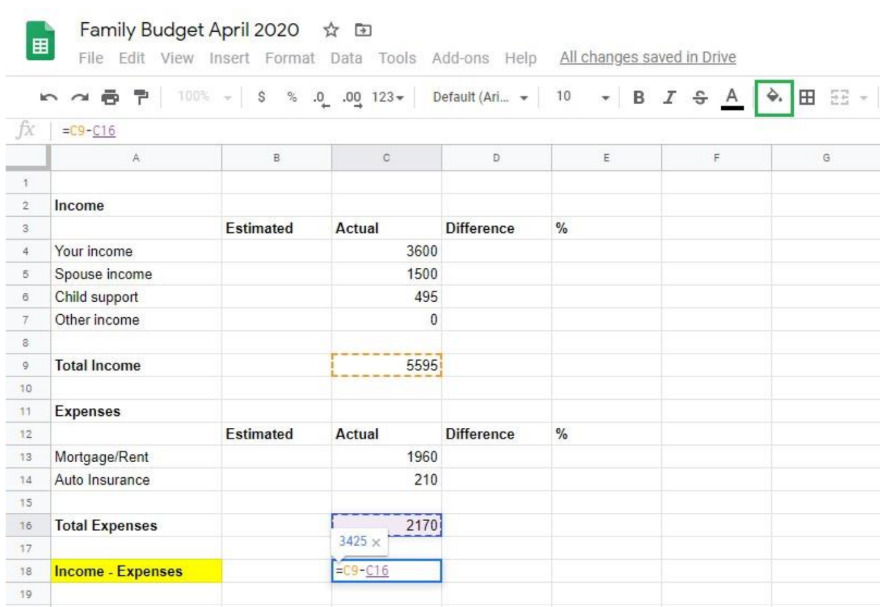

Now when it comes to doing the same process for expenses

You can add the expenses vertically to be under Income or horizontally

I want you to understand the concept and do whatever you like

I added expenses below income as shown below

Cell A18 I added Income – Expenses and highlighted them in yellow by clicking on the paint bucket icon in green sqaure

I went to cell C18 and typed “=” followed by one click on total income amount C9 cell then press the minus sign “-“ followed by total expenses amount C16 cell

You can see the net value of 3425 showing on a tool tip

Hit enter key or return in mac to list the net result in cell C18

So far so good, right now you have a budget

You can expand it according to all of your expenses

Keep in mind all income and expenses are calculated as a percentage based on total income

I went to cell E4 and typed “=” followed by one click on your income amount C4 cell

Then press the divide sign “/” followed by a click on the total income amount C9 cell

Repeat the above 2 steps for all income as shown below

To convert all numbers to percentage

Click on cell E4 and hold down the shift key and press on the last cell which is Other income cell E7

All cells from E4 to E7 will be highlighted then click on the Format as percent button as shown below

Sum all the percentages for total income cell E9, it should be 100% as shown below

I have a family budget sheet for you to use right away, just click on the link below

Click to download for free from my resources page

If you want the flexibility to download it as an excel file to modify it according to your taste

You can download the budget word document and the editable budget in excel sheet for $2

How to plan for a successful budget?

Not all months are the same, if you are getting paid biweekly, 2 months a year you will get paid 3 times a month

Summer months there are more spending on entertainment, December is Christmas or Hanukkah gifts

These events above plus birthdays, your anniversary and whatever are all recurring events

They come at the same time every year so it is manageable and also planned to pay them without any surprises

I am saying the above to initiate you to put them on your calendar and don’t use your emergency fund to pay for these events

1) Create your budget before beginning of the month

The first year of budget is the toughest as you learn new things when you go along

Good news is that after your first year budget a lot of things become repetitive

Bottom line it is highly recommended to create your budget 3-5 days before beginning of the upcoming month

Include all the birthdays, special events and if you have a wedding as you are going to pay a monetary gift when you attend

Wedding especially requires you to add it on your visible calendar like the one you stick it to your fridge

But why?

If you know you have an upcoming wedding for one of your relatives in the after 4 months

Just plan ahead and cut $50 to $75 for 4 months depending on how much you want to pay for the grooms

2) Agree on the budget as a family

According to Dave Ramsey’s book Total Money Makeover

I recommend you to read this book

He describes the spouse working on the a budget with the nerd and the free spirit

One partner creates a rigid budget with no room to breathe and vulnerable for mistakes to happen

Other spouse is the free spirit that cares about the want more than the need

This turns the how to budget process hard to cover all needs

Both spouses should create a budget to agree upon and to commit to follow it

3) Identify your income for the month

Is this a regular month where you will get paid biweekly twice a month

Or one of the 2 lucky months where you will get paid 3 times a month

Or are you getting a bonus

Sometimes some companies deduct more taxes on the first 6 months then they lower the deduction leading to high paycheck after July – August

4) Calculate your fixed expenses

Not all expenses are created the same

- Mortgage/rent

- Internet

- Cable subscription

- GYM

- Netflix

- Cell phone bills

- Car payments

- Home and auto insurances

All of the above fixed expenses are always the same amount every month

You have to deduct them from your income in your budget draft

This gives you a clear picture of how much left on your budget

5) Calculate your variable expenses

Variable expenses like the below ones should not be hard to predict

- Groceries

- Dining out

- Electricity/heating

- Water bill

- Phone data plan (if not unlimited)

- Costs of pet ownership

- Gas

- Credit cards

- Recurring doctor or therapy co-pays

- Prescription costs

Just do the following and you should be OK

I will start by groceries

Check your bank statement or the credit card which you use for paying your groceries for the last 3-6 months

If you find amounts for the past 6 months are pretty much close to each other then take the highest amount and consider it your monthly budget for grocery

If it is fluctuating with reasonable amounts, sum all the 6 months and divide them by 6

For example, $485 + $535 + $405 + $565 + $505 + $360 = $2855 / 6 ~ $475

Consider the above number your monthly estimated budget you carry it over on your draft budget copy

For variable expenses that are really fluctuating like health care expenses

You can have one month $40 dispensing fees for drugs and miscellaneous healthcare items while another month you get a root canal to fix

In this case, create the lower limit of $50 and create a buffer account to have it on your monthly budget to cover these emergencies

Remember you don’t have to touch the emergency fund if your buffer account covers your all of the sudden bill for this month

6) Apply your saving and adjust your expenses accordingly

Stick to a zero based budget as you have to assign a job for every dollar

All of the above mentioned budgeting methods stress on one thing you care about

For example, the value based budget and the reverse budget methods don’t address how you are going to handle your income to meet all expenses

I follow the 10% saving and donating 10% using pay yourself first then following the zero based budget

7) Track your spending frequently

Checking your budget before the end of the month would make it very hard to make any correction if you were already drafted in a deficit

Exception to the above if you are using the envelope system

But since few families use the envelope system, you must and should check your budget progress weekly

You still have a lot of rooms to fix anything before it is too late

8) Adjust your budget based on your mistakes

Mistakes happen even if you track your expenses and review your budget on a weekly basis

What I mean by mistakes, if you decide to budget your grocery to $475 per month

This means your weekly budget is set to $118.75

If you notice 2 weeks in a row you go over $125 and you notice that’s because you buy expensive types of cheese

I am totally against cutting something from your grocery

I always recommend to amend your grocery list to either reduce an item or replace an item you really don’t care about

For example, if you are buying a specific K-cup coffee for your Keurig K-cup machine and it doesn’t matter to replace it with cheaper brand but keep your same type of cheese

Then feel free to do so

You and your spouse are the master of your budget, embrace mistakes in budget as it will teach you to be a financial adviser for your house

9) Make your budget on paper not digital

Yes I meant here paper and not digital

You need paper budget and stick it to a place you always visit at home

The digital spreadsheet budget will help you to make adjustment as fast as possible

In less than a second, you change an item all total amounts will be updated instantly

How do you stick to your budget?

If you followed me in my journey on how to budget your family income on paper and digitally

I don’t know you, I know myself and I know I can stand to good degree against temptation

Nobody is going to force you to follow your family budget but top financial planners found some clues to assist you to stick to your budget

1) Creating your budget with your partner

I mentioned earlier, budget is not a personal decision

If both spouses they don’t agree on every single item on their budget

My advice to both of you, don’t commit to it

My wife knows how much I love blogging and the cost incurred to that

I make sacrifices to other things , my point here is that we have to absorb each other

2) Set a visual board for your financial goals

Nobody can really explain to you the importance of setting a visual board

You have to try it yourself and see how effective it is

Not only to help you stick to your budget but for setting and achieving your goals

Visual boards have the magic as being hypnotized to your dreams

If you look for hypnosis in dictionary, being able to focus deeply on what you are thinking about and this is the state you need to reach it

3) Share your saving goals with other buddy

According to Dave Ramsey’s book Total Money Makeover

He talks about “Keeping up with the Joneses” as you follow what close friends or family members do

It turns out that they were broke too

Look for responsible couples who take the budgeting matters seriously

I also found a forum called MrMoneyMustache that can help you express yourself and find serious people to talk about their experiences on how to budget your household income effectively

4) Add indulgence to your budget

If you really get to know me well

I apply things on myself to see how practical it is before recommending it to my readers

I won’t tell you to cut your morning coffee

According to myself, I reduced my morning Starbucks from 5 days a week to 1-2 times a week

My point here, you know yourself well, make enough room in your budget to help you adapt to any sudden drop in any item

For example, don’t slash going to restaurants item to zero if you love dinning out

I am totally against the other extreme

5) Make sure you set a realistic budget – this requires that you review your monthly budget before the beginning of every month

I said earlier, not every month you will face the same challenges

You can get 3 paychecks in one month, yes it happens twice a year, and you will be able to get your budget on track

Other months you can have a couple of birthdays, I would ask you to skip the meat and poultries every other week or skip the deli

You know this is a temporary workaround and you will be back to normal

That’s what I meant by setting a realistic budget, cut things you can avoid for short period of time

6) Setup automatic transfers for expenses

I discussed earlier how to plan for all expenses whatever fixed or variables

You must be confident to set up all your utilities to be paid automatically

I almost have all of my bills deducted from my checking account automatically

If you want to be on the safe side, you can ask your bank to add the overdraft limit service on your checking account

Bank will charge you one-time fee if any automatic payment overdraft your checking account limit

Point is you don’t want to miss any bill and you end up paying a penalty

7) Create a social calendar

Christmas or Hanukkah always comes on December

Rule of thumb, you have no surprises and that’s why I recommend creating a social calendar

Stick a calendar on your fridge for the upcoming month, resize it reasonably to have each day of the month enough to write the event(s) on that day

The best thing about keeping the social calendar in front of you is that you can add anything that comes on the fly

Like being invited for dinner from a friend where you have to buy a gift for them

You can have 2 colors on your calendar, green for planned events and red for upcoming sudden events

8) Track your spending digitally – excel sheet or mobile apps

You need to track your budget at least once a week

Review it on a digital format so when you make adjustment you get instant update

You need to love the budget concept and not have yourself when summing up all the expenses over and over when you make any slight change

9) Measure your success – measure it on a short and long term periods

The true measure of budget success by experiencing if you encountered any pressure to meet your budget

You can easily follow my steps on how to budget your family income

But how hard was it to reach the zero sum budget If you have difficulty reaching your end of month goals

This is a significant indication that you to review your budget again and again till it works for you with little to no effort

Finally, I hope you find my little effort teaching you how to create a personal budget to be useful

I encourage you to buy the Word and Excel files to start working on your family budget right away for only $2

Now let me show you how to avoid these common budgeting mistakes and how to budget if you’re on low income and then how to build your emergency fund as fast as possible